Stafford loans are the federal government’s primary student loan option for undergraduates. Photo credit: © iStock/dusanpetkovic Stafford Loans Some types of Federal loans are “subsidized” and do not accumulate interest payments during this deferment period. Federal student loans are unique in that, while you are a student, your payments are deferred-that is, put off until later. The federal government helps students pay for college by offering a number of loan programs with more favorable terms than most private loan options. Typically, if you miss payments, the interest you would have had to pay is added to your total debt. Principal payments go toward paying back what you’ve borrowed, and interest payments consist of some agreed upon percentage of the amount you still owe. Like any type of loan (auto loan, credit card, mortgage), student loans cost some small amount to take out (an origination fee) and they require interest and principal payments thereafter. Types of Student Loansīefore getting into the different types of available loan programs, let’s do a quick refresher on how exactly student loans work. Courts have since then issued orders to block the program and the Biden-Harris administration is currently seeking to overturn them. Savings can range from $10,000 to $20,000 in total forgiveness, depending on eligibility. You should note that in 2022, the federal government approved a targeted student loan debt relief program that will offer relief to more than 40 million borrowers and a complete cancellation for roughly 20 million. If you are able to use any of these programs to pay for part of your college tuition, your debt after graduation may be easier to manage. The federal government has a number of different student loan programs, described below, that offer low interest rates and other student-friendly terms. Of course how much you will pay will also depend on what kind of loans you choose to take out.

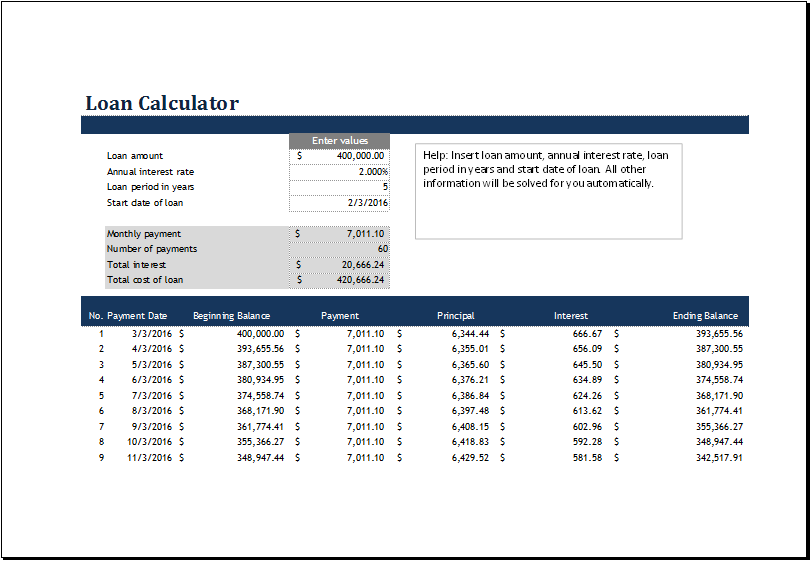

Then with some financial information like how much you (or your family) will be able to contribute each year and what scholarships or gifts you’ve already secured, the student loan payment calculator can tell you what amount of debt you can expect to take on and what your costs will be after you graduate – both on a monthly basis and over the lifetime of your loans. Variables like your marital status, age and how long you will be attending (likely four years if you are entering as a freshman, two years if you are transferring as a junior, etc.) go into the equation. Photo credit: © iStock/fizkesīy looking at a student loan calculator, you can compare the costs of going to different schools. For many students, the only way to stay atop this rising tide has been by taking on an increasing amount of student loans. It’s no secret that getting a degree has grown more expensive in recent years.

Student Loan Calculator: How Long Will It Take to Pay Off?

0 kommentar(er)

0 kommentar(er)